The triumphant growth is over

Svetlana Klimova

It seems that the triumphant growth of the new truck market in Russia has ended. If the market indicators of June 2020 were still higher than those of 2020, but by only 1.3%, then already in July the graphs crossed, and the lag was 10% from last year’s value. What is happening, why and when will it level off? These questions concern all players in the automotive market.

What you should pay attention to

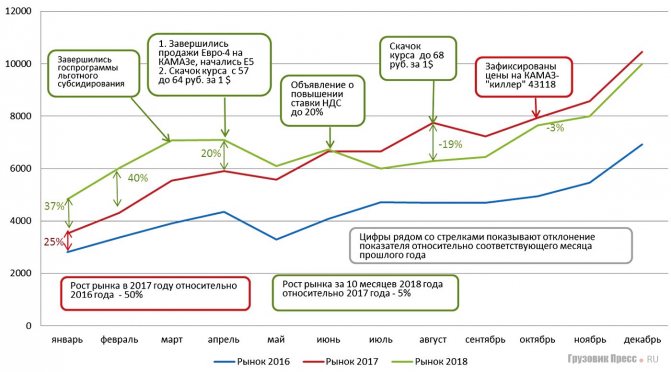

In 2020, the market showed significant growth: relative to the previous year, from 25% in January to 69% in May. In December 2017, compared to December 2020, the dynamics was 51%, and for the year as a whole, the market grew by 50%. This is a very big indicator. For comparison, the average annual growth rate of the truck market in the United States is 34%. In recent years, the Russian market has not been pleased with either stability or serious growth. Therefore, it is difficult to say what indicator is considered normal, but offhand, “normally good” would be dynamics within 20–25%, taking into account the updating of technology and a stable economic situation, and perhaps even less – 15–20%. This means that the figures for 2020 exceeded the “normal” ones by at least 2 times.

In 2020, the situation is somewhat different. Until April, growth continued with excellent figures of +30%, then it slowed down and from July began to lag behind last year’s figures. In August, the market dropped by 19%. As a result, relative to the same period last year, over 10 months the market grew by only 5%.

The diagram shows the events that had a direct impact on the market (it seems that the greatest).

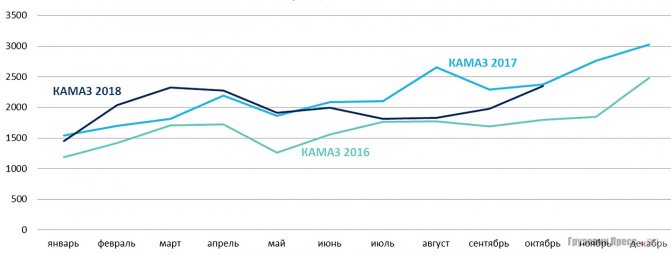

The dynamics of sales volumes of new KAMAZ trucks has been positive since mid-2020. In December 2020, KAMAZ sold a record 3,000 trucks and planned to continue growing. However, a not very noticeable change occurred already in April, the curve turned down, but the situation did not look dangerous. The trend continued in May, but was also not too stressful - May traditionally shows a decline due to long holidays. The situation began to seem alarming in July. The lag not only from ambitious targets, but also from the results of 2020 has become too serious.

We can offer two hypotheses regarding the market in general and one regarding KAMAZ.

Commercial vehicle market statistics for 2020 Transport

The commercial vehicle market began its decline two years ago, but in the winter of 2020 the decline in sales volumes was very noticeable. Most likely, in the next two years the situation on the truck transport market will change for the better thanks to government support, but only slightly.

According to the analytical agency Autostat, 4,700 new trucks were sold in January 2020, which is 28% less than in the same period in 2014. Sales of light commercial vehicles fell by 25.6% to 6,800 units. Thus, in January of this year, the overall decline in the segment of LCV-class cars and trucks reached 27.2%.

According to analysts, there is nothing unusual in these figures, since the Russian market has been showing negative results since 2013. If the year before last the drop in sales was 14.3%, then last year the decline exceeded 24%. According to leading analyst Azat Timerkhanov, the reason for the difficult start to 2020 is the difficult economic situation in the country.

The only thing the LCV market can count on is the extension of the recycling program, under which about 12% of light commercial vehicles were sold in 2014. Azat Timerkhanov believes that in 2020 the program will help increase LCV sales, but it will not solve all problems. The jump in car prices and rising interest rates on loans have already led to potential buyers being unable to purchase a new car, so the market decline will intensify this year and reach its bottom in the spring of 2016, after which we can expect some improvement in the situation.

The truck market is falling even further, with no hope of any growth in the near future. Stabilization in this segment is possible no earlier than 2020. According to Alexey Bezborodov, director of the research agency Infranews, cargo carriers have nothing to transport, therefore, they will not renew their vehicle fleet. The main direction of work of transport companies today is to increase the efficiency of logistics activities, thanks to which carriers will be able to manage with fewer vehicles.

Positive changes are observed only in the export of trucks. Thus, in the fourth quarter of last year, export sales of KamAZ trucks doubled. They also count on growth in exports of their products, namely the Gazelle Next model.

Did you like the article? Share:

TRANSPORT COMPANIES AND CARRIERS

If you are interested in receiving applications for cargo transportation in a certain direction, please contact us by email

Registration in the database of transport companies is free.

Regarding advertising, please also contact us via the above email.

First hypothesis regarding market growth

Deferred demand in 2020 was satisfied ahead of schedule, which was stimulated by purchases related to the development of the budget allocated for the implementation of large government projects.

A hypothesis follows from two facts and one assumption.

1. In 2020, pent-up demand began to be realized, so the market grew very quickly and, as a result, grew 1.5 times compared to 2016. The market dynamics were significantly different from those in 2016, when the market grew by 4% relative to the previous year, so the beginning of the realization of pent-up demand in 2020 can be considered a fact.

2. In 2020, the implementation of major government projects (Crimean Bridge, construction for the World Cup...) was completed - a fact.

3. Toward completion, perhaps budgets were used and equipment was purchased for future use - an assumption.

Second hypothesis regarding the fall in demand

The natural pullback after the surge is more likely not a fall, but a return to normal, and this could last until the middle of next year - the advanced demand will be compensated.

If we assume that “normal” growth would be 25%, then recovery will occur by the middle of next year. Under the “normal” growth scenario in 2020, the market would have been around 66,000 (instead of the 80,000 received), and we would have arrived in December 2020 at the now expected 83,000, instead of the 102,000 trucks predicted by PwC in the first half of the year. I would like to think that since everything turned out this way (the planned 83,000 took place in December), then a new life will begin in January, but this is unlikely. There will be accumulated negative factors associated with unfulfilled expectations of automakers and general instability.

The third hypothesis about the KAMAZ sales crisis

Preamble. 2020 is a turning point for KAMAZ - the plan was to sell more than 10,000 new trucks and cross the 40,000 mark in total production. The planned growth for 2020 relative to 2020 was more than 60%. Based on the implementation plans, production also worked. And in November, the company already announced a downtime for three days, there are rumors about serious downtime in December and a shutdown of the conveyor in January 2020. KAMAZ is falling faster than the market and, in all likelihood, will return to last year’s levels.

So, the third hypothesis. KAMAZ overfed the market with “killers” and thereby undermined sales of its own vehicles at normal prices.

The long period of sales of “killers” (more than 6 months) has accustomed consumers to this extremely low price level for KAMAZ. Comparison of prices (“frozen” back in October last year) for “killers” and for updated models is in strong contrast and does not contribute to the consumer’s feeling of a fair price and trust in new cars. A kind of cannibalism: a cheap product segment did not allow the development of a new, much more expensive one.

Omnicomm research: the transport telematics market in Russia is growing by 8% per year

Business Financial Results

Telecom IT infrastructure in the public sector

04/23/2019, Tue, 10:22, Moscow time

Omnicomm has published the results of its ninth annual study of the Russian transport monitoring market. The survey involved 1.27 thousand manufacturers, software and telematics equipment developers, IT integrators, distributors and representatives of service companies.

At the end of 2020, the volume of the main market segments amounted to about 14.9 billion rubles. and grew by 8.5% compared to 2020 data (RUB 13.7 billion).

Market structure: RUB 10.5 billion. accounts for revenue from the subscriber base of platforms for monitoring transport, 2.1 billion rubles each. – on segments of terminals and fuel level sensors.

More than 2 million vehicles and stationary objects are connected to transport monitoring systems, the volume of the accumulated subscriber base increased by 6.6% compared to 2020 (1.95 million objects).

The increase in the subscriber base of the main developers of software for transport monitoring was: Omnicomm - 27%, Gurtam - 14%, Technocom - 7%.

According to Autostat data, at the beginning of 2020, the share of freight and light commercial vehicles in the structure of the Russian vehicle fleet, which primarily uses telematics, amounted to 14.4% or about 8.3 million vehicles. Experts from the Omnicomm analytical center note that in 2020, the transport monitoring market showed stable growth – within 8%. The volume of new connections amounted to 250 thousand terminals and 190 thousand fuel level sensors. According to Omnicomm, the total penetration rate of transport monitoring technologies has reached 15-17%, but this figure differs significantly by segment. The highest figure – up to 50% – is in long-haul transportation, and in light commercial transport the share is only 5%.

The share of revenue from the software subscriber base is more than 70% of the transport monitoring market. The leaders in subscriber base growth were the Russian platform Omnicomm Online/Omnicomm (+27% compared to 2017), Wialon/Gurtam (+14%) and Autograph/Technocom (+7%). In the segment of terminals for transport monitoring (15% of the market), the leaders are Omnicomm (25%), Navtelecom (19%), which offers equipment in the budget price segment, and Technocom (17%). In the fuel sensor segment (also 15%), the leading positions are held by Omnicomm (37%), Technocom (16%) and Escort (16%).

The transport telematics market in the fuel level monitoring segment is close to saturation - the penetration share reached 76% in 2020. At the same time, there remains a high market potential for further equipping vehicles with terminals integrated with online platforms for transport monitoring. According to the results of the study, corporate clients are interested in supporting the safe driving function (25% of respondents), and in temperature control technologies during transportation (for example, IQFreeze) - 22%. The demand for terminals that support the data transfer protocol within the framework of the Ministry of Transport Resolution No. 153 reaches 20%, 15% of respondents expressed interest in video terminals.

“An important driver of the transport monitoring market is the position of the state, which seeks to take control of freight flows, infrastructure management, and also reduce road deaths. According to our assessment, the increase in the number of connections will primarily be realized on the basis of the existing commercial vehicle fleet. From July 1, 2019, tachographic control of freight and passenger transport comes into force, which can contribute to an increase in new connections by 40%. So far, most tachographs are used to collect data on the driver’s work and rest schedule, but in the future they can be connected using special devices to an online platform for monitoring vehicles and transmit parameters such as speed, cargo weight, temperature conditions and others. For example, Omnicomm, together with a leading tachograph manufacturer, has developed a solution that will simultaneously meet the requirements of the Ministry of Transport and obtain data for monitoring transport in real time,” said Alexander Selivanov , executive director of Omnicomm.

In general, without taking into account the contribution of regulators, the transport telematics market could grow up to 10% due to sales of commercial vehicles and existing telematics services, according to Omnicomm.

- TURBO TORO: new IT capabilities in repair management

- Short link