How the road freight transport market works in Russia

The cheapest way to deliver raw materials or finished goods from the manufacturer to the consumer is considered to be the railway - but due to the fact that its network is unevenly distributed throughout Russia, and Russian Railways is a huge bureaucratic machine, when talking about freight transportation, we are most often talking about road transport. It would seem that in Russia they produce ordinary trucks and truck tractors (not only KAMAZ, but also, for example, Volvo), roads are gradually being repaired while there is still cargo - this market should be attractive.

In practice, however, this does not happen. Unlike the same railway, there are no traces of a monopoly in road freight transportation - according to some data, the 10 largest transport companies in Russia account for less than 16% of freight turnover

. The basis of the market is small private carriers, often even individual entrepreneurs (who can be both the owner and the driver at the same time).

It is not so easy to attribute this to problems in the economy - according to official data, until 2020, industrial production grew, as did retail trade. This means that there are loads

– but why then do carriers complain so much about the lack of income?

Most participants in the road transportation market believe that the market now belongs entirely to customers. In simple terms, this means that the customer can choose from a variety of carriers - most likely the one who offers the lowest price. And this happened, as the industry believes, due to the active development of electronic services for booking transportation.

Some people call this “uberization” - by analogy with the famous taxi service Uber, which has significantly lowered the barrier to entry for taxi drivers. As the director of the event company Alexey Chalikov

, thanks to electronic services, classic transport companies will eventually cede the market to private owners:

The functionality of cargo transportation web services allows you to completely exclude line personnel (logistics, forwarders, managers) from the transaction, automate the process of creating accompanying documents and their transfer to the parties to the agreement. This is a clear financial advantage for private owners over owners of large fleets. But questions remain about cargo safety, insurance and compliance with delivery deadlines. If the “uberization” of freight transport is improved, this will provide a new chance for survival for private owners. As Darwin said, “It is not the strongest or the most intelligent who survive, but the one who best adapts to change.”

Uberization will not only make it cheaper, but also make the transport services market more civilized. Transportation prices can no longer be called high. For small transport owners, this service will provide direct access to orders from large cargo owners, which was previously inaccessible to them.

Alexey Chalikov , director of Heavy World.

It turns out that drivers have a choice of two options:

- join a transport company - receive transportation assignments and pre-agreed payment from it;

- become a “company” yourself - independently search for orders through electronic platforms (by the way, in theory there may also be orders from transport companies).

Both options have their drawbacks - you shouldn’t count on high tariffs from transport companies (otherwise how will they make money themselves?), and in the case of working for yourself, you will have to dump again in order to take orders from the same independent carriers.

When talking about electronic services, they often mention AutoTransInfo (which some time ago became the “ATI.SU Freight Exchange”). For example, the CEO of a logistics company Andrey Eremin

believes that ATI is the reason that the transportation market has become so transparent and low-income:

ATI is essentially a very advanced idea, especially for 1998, when the trademark was registered. They made an aggregator when it was not yet mainstream. This is surprising - many Yandex.Taxi users were not even born yet when the founders of ATI had already come up with the prototype of this service for trucks, which to this day no one can replicate. By the way, about trying to repeat it, Uber tried to launch an application about 3-4 years ago, but nothing came of it.

The most insidious thing about this platform is that it gave rise to wild competition and the concept of “return”, although before that carriers always counted round-trip rates, and if they managed to catch the cargo on the way back, it was more of a pleasant bonus rather than a forced measure. so as not to work at a disadvantage. Of course, this is an excellent way to collect statistics on market conditions, but in the right hands, these statistics turn against the carriers themselves, forcing them to work on the brink of profitability.

ATI has also become a good tool in the hands of fraudsters, since many forwarders in checking counterparties are guided only by the stars in the ATI, ignoring the simplest tricks in the form of an email address changed by one letter, for example. Not every start-up transport company can survive cargo theft and get out of the current situation with dignity in relations with the customer, and this also largely contributed to the closure of the business of many individual entrepreneurs.

Andrey Eremin , General Director.

In other words, the electronic platform simply brings customers and carriers together directly, but this turned out to be exactly what transport companies were actively making money on before. And the development of digital technologies in this case played against transport workers, bringing down tariffs to the market minimum and thereby seriously undermining their incomes

.

For the same reason, the approach to transportation has changed among customers - seeing competition for customers, they include extremely strict conditions in contracts, such as fines for every hour of delay - even if the cause of the delay has nothing to do with the driver or carrier. At the other extreme, some customers agree to cooperate only with the condition of deferred payment, which can reach up to 4-5 months.

It turns out that progress has brought the entire industry to the brink of survival. Some could not survive - in addition to hundreds and thousands of individual entrepreneurs who decided to leave transportation, one of the large ones went bankrupt a year and a half ago. And the coronavirus pandemic has obviously only added to the industry’s problems.

What's happening in the market now

The road freight transportation market has been doing relatively well in recent years - it clearly fell during the crisis year of 2009, after which it began to grow again. Rosstat data show that the share of motor transport in cargo transportation has always been about 4-5%

– not so much due to the freight turnover of railway and pipeline transport:

But transport serves production - and if production stops for some reason, freight flows also stop. This happened all over the world in the spring of 2020 - it all started with the shutdown of many production facilities in China, and then spread to the whole world

. Already in April, the business expected serious losses, and they definitely will. Even in the base case scenario, traffic drops by 10%.

There is another approach - given that transportation directly depends on the performance of the economy (primarily production), each lost percentage of GDP gives a minus 3% to freight transportation. Considering that most departments expect Russia's GDP to fall by 5% by the end of the year, transportation could lose up to 15%.

The decline has not stopped yet - according to the same Rosstat, transportation since March has fallen below last year’s values

:

The current crisis will only aggravate the problems of the transportation market - when demand drops sharply, and supply remains at the same level (private owners cannot leave families without money, and companies cannot leave workers without wages), then transportation rates will fall further - to the limit of the minimum acceptable profitability .

However, in some places transportation has received a new impetus for growth - these are courier delivery companies in cities. Due to the previously introduced self-isolation regimes throughout the country, the demand for delivery services has increased not just significantly, but by orders of magnitude. And due to this, the segment was able to show growth, says the head of the transport company, Eduard Kholimonenko:

If we talk about small-tonnage transport, then “loners” (who have up to 2-3 units of equipment) worked as they did several years ago, and they still work now. In large cities, the demand for their services remains stable: this includes trade, moving, and intraregional movement of goods. In 2020, it even grew due to the development of e-commerce and increased demand for courier delivery. I am confident that individual entrepreneurs (as well as the self-employed) will retain their share even in the context of the further development of the large systemic transport business. Although this market is not easy for them, they need to work a lot, negotiate, look for contacts, etc., so they definitely won’t be able to sit on the stove.

Eduard Kholimonenko , General Director of Baikal-Service Yekaterinburg LLC.

On top of the existing problems, others were superimposed:

- rising fuel prices;

- devaluation of the ruble, due to which spare parts for trucks and the trucks themselves have become more expensive;

- for some time, service centers and auto repair shops could not work, and carriers could not maintain their fleet;

- increasing the recycling fee to redirect demand for cars produced within Russia, etc.

But who found it easier to survive the crisis – large companies or small firms and individual entrepreneurs?

Freight transport losses worldwide will exceed €550 billion in 2020

Transport losses threaten global economic recovery, the IRU says.

More than 3.5 million road transport operators are facing unprecedented losses this year due to transport restrictions and the general economic downturn caused by the pandemic, a new IRU study has found.

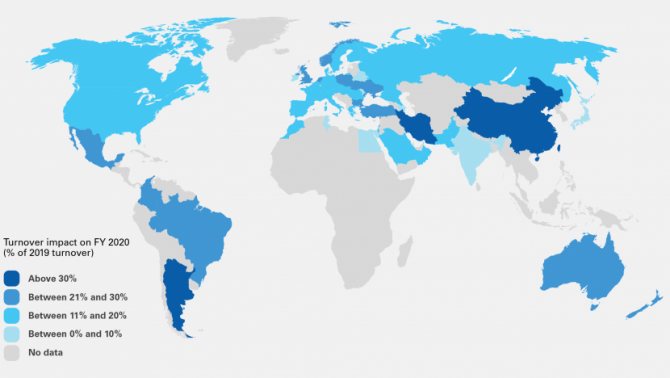

In 2020, freight transport losses worldwide will exceed 550 billion euros, with a decline in revenue of 18%.

Freight carriers expect an average revenue decline of 18% in 2020, which corresponds to 551 billion euros. The sector is suffering serious losses in regions such as the Middle East and North Africa (-22%), Asia (-21%); in Europe, sector revenues decreased by 64 billion euros (-17%). Businesses in Argentina, Iran and Chile are experiencing declines of more than 30%.

Source: iru.org. Assessment of the impact of the crisis on the turnover of the freight industry in the 2020 financial year as of April 2020. Geographical coverage: IRU Member States with data to assess the impact of the crisis on freight industry turnover.

Clear measures are needed to restore the industry.

Most freight operators report that during the most stringent lockdowns, there were more restrictions than transport support measures in place, exacerbating the impact of the crisis on the industry.

Road transport services are the backbone of the economy and social life in all countries of the world. The new data we have received is of great concern. The freight transport industry will feel the pain of every single road transport operator going bankrupt, says IRU Secretary General Umberto De Pretto.

The IRU has published a 10-point recovery plan that calls for governments and banks to provide financial and non-financial measures to support struggling road transport operators, ease the movement of passengers and goods and support global economic recovery. However, very little has been done since then, and in some cases no action has been taken.

Many governments have clarified legislation and announced the implementation of a set of recovery measures, but, as a rule, assistance to road transport operators is not specified, says Umberto de Pretto.

Our survey indicates that the industry urgently needs targeted measures commensurate with the scale of the current situation. Even at the peak of the crisis, road transport adapted to the conditions, continued to operate and, as before, played a unique role in the life of society. Today, without clear government support for road transport operators, economic recovery efforts are at risk.

Without government support

If market participants are to be believed, small transportation companies and private drivers are living worse and worse from year to year – and this started long before the pandemic. For example, Andrei Eremin believes that in addition to the ATI system, one of its participants was involved in the destruction of the transport industry:

“Business Lines” sent a large number of small carriers to the bench due to their pricing system and strict dumping. The fact is that “Business Lines” do not make money on transportation at the time of its completion; the economic formula includes only leasing payments, office maintenance, fuel and lubricants and the driver’s salary. Earnings are included in the sale of equipment after payment of leasing payments. And individual entrepreneurs, without realizing it, support an economic scheme that is killing them, buying Business Lines trucks just below the market, not realizing the fact that Business Lines has already taken this difference from him tenfold at the expense of the profits that he didn't receive enough Such is the irony of fate.

Andrey Eremin , General Director.

In addition, the expert believes, transport workers are not very popular in banks and the tax service. Thus, the Federal Tax Service considers this market risky from the point of view of cashing out money, and because of this, banks set higher commission rates for companies with the corresponding OKVED codes.

And there is also a problem with VAT

. The fact is that it is more profitable for shippers to engage carriers who work with VAT - this way they receive the right to a tax deduction (this is the essence of VAT itself), and the tax office does not have unnecessary questions. According to Andrey Eremin, because of this, intermediaries in the form of freight forwarders appeared on the market. They officially work with VAT, but in fact private traders work for them - without VAT. And these private owners also lose because they cannot return VAT on purchased fuel or spare parts, since they themselves are not included in the supply chain.

also told us about the role of the tax service in industry transformations :

For many private entrepreneurs and individual entrepreneurs, 2020 becomes a turning point in deciding whether to continue working in this market. Firstly, at the moment there is a strong imbalance in the supply of road transport services due to a shrinking market due to the coronavirus. Secondly, VAT calculation schemes without VAT have practically disappeared, or the cost of this scheme has increased by 2-3 times due to active actions on the part of the Federal Tax Service. Because of this, small carriers cannot enter into contracts with customers since the latter are on the general taxation system, and the vast majority of individual entrepreneurs are on UTII. Thirdly, the indirect “Plato” tax appeared.

Given this state of affairs, private carriers operating in narrow niches, those who have business connections with large customers, and self-employed people who do not pay payroll taxes may remain on the market. Those who work through forwarders and/or through the ATI.su exchange will leave the market.

In 2021, with the introduction of the electronic consignment note and the abolition of UTII, most small carriers will stop operating or switch to working as part of the transport departments of federal companies.

Oleg Vasiliev , deputy director of ANO DPO "SZRTsOT".

will not receive serious support from the state in 2020

, even if they work absolutely legally. All types of assistance (interest-free loans, salary subsidies, tax exemptions for the second quarter) were received by business from among the most affected industries - but among the carriers there is only air transport.

Only the self-employed

(professional income tax payers), but taking into account the peculiarities of calculating NAP, there are few self-employed among transport workers.

Russia is going to dramatically rejuvenate its fleet of trucks and buses by mid-2020

Russia, at the highest state level, has taken up the radical rejuvenation of its national fleet of trucks and buses. Old equipment whose service life exceeds the guidelines will be deregistered and sent to the press simply due to age. Fans of “old timers” who disagree with the general line of the government will face severe fines...

The Ministry of Industry and Trade of the Russian Federation came up with a corresponding initiative. This week, on the Unified portal regulation.gov.ru, a draft amendment to the federal law “On Road Safety” was posted for public discussion, which provides for the introduction of “life limits from the date of manufacture for all categories of commercial vehicles.” The latter means that once a vehicle (vehicle) reaches a certain age, its further operation is prohibited, the truck/bus must be deregistered and disposed of.

The most radical rejuvenation (of course, if amendments to the law are adopted) awaits the fleet of light commercial vehicles with a gross weight of no more than 3.5 tons (vehicle categories N1, N1G). As of January 1, 2020, all cars aged 18 years and older will have to be taken out of service. From January 1, 2020, cars 15 years and older will begin to be scrapped. Well, after July 1, 2020, not a single light truck or van older than 12 years will remain in Russia.

Trucks with a gross weight of 3.5-12 tons (vehicle categories N2, N2G) are subject to the following “executions”: in January 2016, all vehicles over 20 years old will be sent to the press, in January 2017 - over 18 years old, from July 1 2018 - over 15 years old.

Trucks with a gross weight of more than 12 tons (vehicles of categories N3, N3G) are treated with an incomprehensible humanism - their service life will be reduced to a much lesser extent. Thus, from July 1, 2020, only cars older than 28 years will begin to be scrapped, from January 1, 2017, those older than 26 years, and after July 1, 2018, only cars no older than 25 years will remain in service.

For buses with a gross weight of no more than 5 tons (vehicle categories M2, M2G), it is proposed to establish the following service life limits: a) 18 years - for the period from July 1, 2020 to December 31, 2020; b) 15 years - for the period from January 1, 2020 to June 30, 2020; c) 12 years - for the period from July 1, 2020.

For buses with a gross weight of more than 5 tons (vehicle categories M3, M3G), the service life limits are as follows: a) 25 years - for the period from July 1, 2016 to December 31, 2020; b) 20 years - for the period from January 1, 2017 to June 30, 2020; c) 15 years - for the period from July 1, 2018.

Consequences? If all the changes proposed by the Ministry of Industry and Trade of the Russian Federation are introduced into the federal law “On Road Safety,” then in the next three and a half years approximately 184 thousand light commercial vehicles, 81.5 thousand trucks and more than 36 thousand buses (calculations are based on data on vehicle registration in the traffic police). For automakers, such a dramatic update opens up very tempting prospects. Only advantages await road users: less traffic on the roads means fewer accidents. But owners of commercial vehicles today need to start thinking about where to get money for new equipment.

Violators of vehicle service life limits must be detained by traffic police officers and mercilessly fined. It is proposed to establish the following amounts of penalties: for legal entities and individual entrepreneurs - 200 thousand rubles. (naturally, Russian!), for officials - 50 thousand, for citizens - 30 thousand rubles.

Sergey GRISCHENKO ABW.BY Photo from their editorial archive